Briefing Paper

A data and digital trade policy for the UK - economic, societal and industrial policy aspects

Morita-Jaeger, M. Borchert, I. Li, P. Savona, M (2025) A data and digital trade policy for the UK - economic, societal and industrial policy aspects, CITP Briefing Paper 22

Published 11 April 2025

Briefing Paper 22

Minako Morita-Jaeger, Ingo Borchert, Phoebe Li, Maria Savona

Policy recommendations

The UK Government should:

- Take a proactive role in making digital trade rules at the international level.

- Explore whether successful policy configurations for increasing bilateral services trade in ‘deep’ services agreements or FTA chapters, could be replicated in digital trade chapters in FTAs or standalone Digital Economy Agreements (DEAs).

- Join existing open-ended agreements such as the Digital Economy Partnership Agreement (DEPA) to improve policy certainty.

- Aim to avoid international regulatory fragmentation by maintaining strong multilateral commitments such as efforts towards the WTO Joint Statement Initiative on E-commerce.

- Promote policy dialogues on data and digital trade outside of the WTO, involving a wide range of stakeholders including those outside of conventional policymaking communities.

- Align data and digital trade policy with broader societal objectives:

- by reviewing key provisions in UK trade agreements (and DEAs)

- By promoting a multi-stakeholder approach to the digital trade regulatory environment.

- Pursue regulatory cooperation using soft law, such as sectoral standards and Memorandum of Understanding (MOU) with like-minded trade partners.

- Improve both the collection of relevant statistics and its conditions of access for civil service and academic researchers.

- Integrate digital policy with both the industrial and trade strategies.

Acknowledgements

This paper draws on a roundtable on digital trade policy jointly organised by the Centre for Inclusive Trade Policy (CITP) and the Department of Science, Information and Technology (DSIT). The views expressed therein are entirely those of the authors and do not reflect the position of the UK Government. The authors also thank Ioannis Papadakis for his presentation at the roundtable, Jiyeong Go for drafting a note of the roundtable and Filippo Bontadini for producing Figure 4.

Introduction

The UK has been actively creating digital trade rules since leaving the EU. It has successfully concluded some advanced digital trade chapters under its FTAs (e.g. UK-Australia, UK-New Zealand, UK-Japan and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)) and two standalone Digital Economy Agreements (DEAs) with Singapore and Ukraine. At the multilateral level, the UK became a member of the Joint Statement Initiative on E-Commerce at the World Trade Organization (WTO), the text of which was finalised in July 2024. These developments constitute important elements of a digital trade policy architecture in addition to services trade chapters under existing UK FTAs and commitments under the WTO General Agreement on Trade in Services (GATS).

Currently, the UK Government is preparing a trade strategy, to be published in spring 2025. As the UK Government sets economic growth at the centre of trade policy, data and digital trade policy should be one of its main pillars. At the same time, as the government aims to align its trade strategy with its industrial policy, economic security, and net zero ambitions, data and digital trade policy needs to adopt a holistic approach to be consistent with and contribute meaningfully to other public policy areas. In terms of policy instruments, there is a need to better understand the role that FTAs/DEAs can play in shaping data/AI governance.

This Briefing Paper aims to input into the development of the UK’s digital trade strategy. With an overview of the environment in which digital trade takes place, the paper covers three interrelated topics which we suggest should be borne in mind in the design and implementation of a data and digital trade policy for the UK:

(i) Drawing lessons from the economic impacts of preferential services trade agreements

(ii) Addressing the role of digital trade rules in data and AI governance, and

(iii) The importance of the alignment of digital trade policy with industrial policy.

We identify some key lessons and analyse the policy challenges, which leads to a set of policy recommendations.

The rapid pace of digital technologies’ development and digital trade

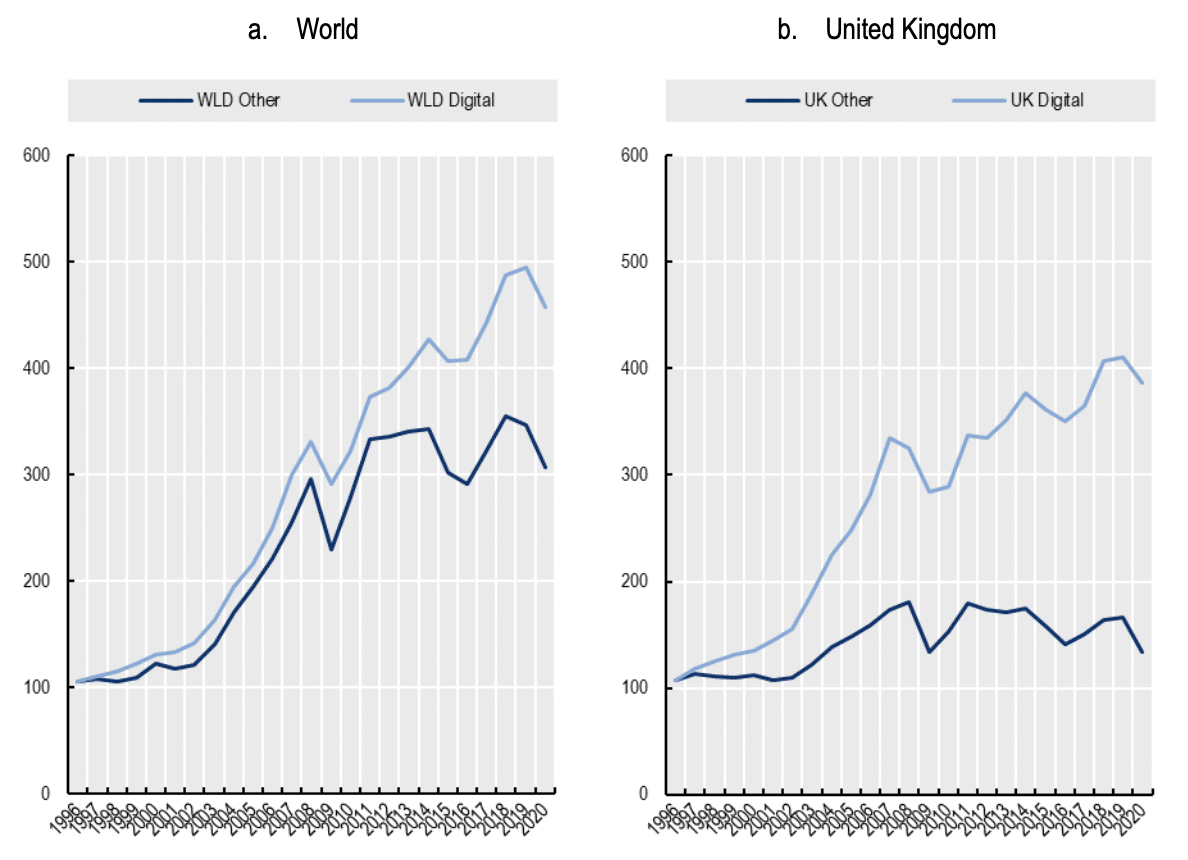

Global digital trade has been growing faster than ‘other trade’ over the last few decades (Figure 1.a). As of 2020, global digital trade1 accounts for about 25% of world trade. The UK’s digital trade exports became more than half of its total exports in 2020 and have clearly been growing much more vigorously than the UK’s ‘other exports’ (Figure 1.b).

Figure 1: Growth of global and UK digital trade (1995-2020)

Source: Gonzalez, J.L., Sorescu, S. and Giovane, C. D. (2024), “Making the most out of digital trade in the United Kingdom”, Figure 4. OECD Trade Policy Papers No. 285

The international landscape and context within which the UK Government is formulating its independent (digital) trade policy has been changing dramatically. In terms of geopolitics, the world trading order has been shifting from ‘liberal’ trade to ‘resilient’ trade, sparked by intensifying US-China hegemonic conflicts and other international events such as the Covid-19 pandemic and the war in Ukraine.2 The previous US Administration under President Biden shifted the US’s digital trade policy from a laissez-faire approach focused, for example, more on free flow of data as opposed to privacy concerns, towards a more balanced approach using regulations and competition policy.3 The current Administration under President Trump is reversing its predecessor’s policies. For example, President Trump revoked the Biden administration’s Executive Order on Safe, Secure and Trustworthy Development and Use of Artificial Intelligence and issued a new AI Executive Order titled “Removing Barriers to American Leadership in Artificial Intelligence” in January.4 At the international level, the US, together with the UK, refused to sign a declaration which aimed to ensure ‘safe, secure and trustworthy’ AI environment at the AI global summit in Paris in February 2025.

Emerging technologies such as generative AI are evolving at unprecedented speed. These technologies are creating new economic opportunities whilst at the same time presenting novel societal and environmental challenges that are inherently international in nature as digital intermediary platforms (DIP)5 have global reach but are located mostly in the US or in China. Conversely, the way in which digital services are ‘footloose’ and supplied by only a few global DIPs greatly increases the potential of avoiding national regulation in the first place or rendering it ineffective. Typically, policymakers have found it very hard to keep pace with these technological developments.6

These two developments combined create a ‘double whammy challenge’ for digital trade policymakers. Trade policy needs to be consistent with a range of public policy areas that evolve largely independently, and therefore requires a more holistic approach that entails economic, technological, societal, and environmental perspectives. But it also requires more agility and speed than ever before as, for instance, AI systems and their underpinning datasets may become outdated within months, whereas regulatory approval cycles for such systems can span years.

Economic impacts of preferential services trade agreements

The economic value of deep services trade agreements

Governments promote preferential services trade agreements, and most recently stand-alone digital trade agreements for digitally delivered services trade and digital innovation. Yet, there is a limited number of empirical studies that investigate the economic value of such preferential trade agreements. For the UK, evaluating the economic value of the UK’s services trade agreements and digital trade rules under FTAs is imperative to inform a medium-term digital trade strategy. Although the following does not provide an empirical study of the UK’s digital trade agreements,7 it suggests that deep services trade agreements can be a useful policy tool to promote services trade and value added.

A recent economic analysis8, which focuses on the effect of deep trade agreements that contain provisions applicable to services trade (hereafter “Services DTAs”) is based upon information from the World Bank’s Deep Trade Agreements 2.0 database. The data is a mixture of information about the agreements’ architecture and the prevalence of certain disciplines; for instance, information is available as to whether there is a dedicated chapter for each of the main modes of services supply (agreement architecture) and whether a certain trade-inhibiting practice, such as mandatory technology transfer or local content requirements, is barred. Taken together, both dimensions confer a sense of an agreement’s level of ambition.

Empirically analysing provisions from 143 trade agreements with services provisions, the study documents substantial trade-enhancing effects but only in instances of “deep” trade agreements, i.e. ones that combine an ambitious agreement structure with meaningful disciplines and provisions that ensure accountability. These cases highlight the transformative potential of ambitious policy provisions as the associated impact is estimated to increase bilateral services trade by 15 to 65 per cent. The analysis leverages variations across economies and the timing of agreements, examining changes in bilateral services trade flows before and after agreements while accounting for exporter-specific, importer-specific, and country-pair trends.

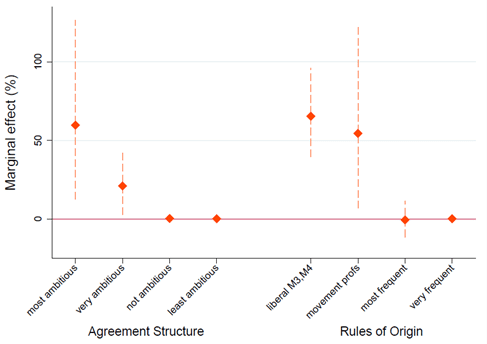

The results also emphasise the importance of policy configurations, i.e. bundles of provisions that complement each other. One such dimension, for instance, concerns the structure of agreements: those with multiple chapters across modes of supply, a negative list approach towards liberalisation, and standstill or ratchet clauses deliver significant trade effects compared to less comprehensive and ambitious policy configurations in that regard. The same is true for provisions concerning rules of origin, particularly in Mode 4 (movement of professionals) as the country of origin of a service is more complex than for goods. Figure 2 shows the marginal effects, in terms of percentage increases in the value of bilateral services trade, associated with ambitious provisions in these two dimensions.

Figure 2: Impact of ambitions provisions in DTAs on services trade

Source: Authors’ elaboration based upon Table 4 in Borchert and Di Ubaldo (2021).

Although these insights into the trade effects of deep services trade provisions are obtained from an ex-post analysis of “conventional” trade agreements, it is not unreasonable to assume that similar effects are at play in digital trade and digital economy agreements (DEAs). Whether and how provisions in these digital economy agreements rely on, or otherwise interact with, provisions in services chapters of conventional trade agreements is an interesting aspect that awaits scrutiny.

With regard to the impact on trade, a complementary and potentially quite important aspect concerns the degree of certainty over trading conditions. In some sense, this is one of the factors behind the aforementioned results of deep services trade agreements, as these provide businesses with certainty over market access conditions and other aspects of exchanging services internationally. At the same time, however, these provisions also alter trading conditions and as such do not isolate the trade-enhancing effect of uncertainty removal alone. In the context of conventional goods trade, uncertainty reduction has been shown to have an independent and sizable effect in boosting exports, and it is perhaps not far-fetched to also expect a similarly beneficial effect of regulatory certainty on digital trade.

In the context of services trade, certainty in the form of “bindings”, i.e. bringing multilateral commitments such as GATS schedules in line with applied Most Favoured Nation (MFN) policy, has been shown to be associated with higher values of services trade; much of this (small) literature is based on work using the OECD’s Services Trade Restrictiveness Index (STRI). For example, differences between MFN STRI and preferential STRI commitments illustrate how agreements such as CPTPP address uncertainty. Countries like New Zealand, Japan, and Canada have narrowed the gap between preferential and applied commitments, demonstrating reduced uncertainty, while others, such as Chile, show significant gaps, reflecting greater unpredictability. Extending these approaches to digital trade could yield similar benefits by ensuring internationally compatible frameworks for copyright, intellectual property, and data transfer mechanisms.

If anything, the importance of certainty is amplified in digital economy and services trade, because the production of most services, including digital products, are typically characterised by high fixed costs and low marginal costs. Certainty enables firms to confidently scale operations globally, enhancing the value of trade agreements. In contrast, sectors with low fixed costs and high marginal costs derive less benefit from certainty. This distinction underscores the need for clear and stable trade policies, particularly for industries reliant on digitalisation and cross-border services. While challenges remain, addressing policy uncertainty and aligning trade agreements with practical realities are essential for maximising their transformative potential.

Digital trade provisions have implications that extend beyond traditional metrics, influencing areas such as intellectual property protections, healthcare service mobility, and cross-border data flows. These provisions foster innovation, improve access to essential services, and enhance global value chains, particularly as digitalisation increasingly blurs the distinction between goods and services. The rise of servitisation, where firms integrate service components into goods-based offerings, illustrates how trade policies must adapt to evolving business models.

Policy challenges

For the UK, evaluating the effectiveness of its trade agreements, covering both “Services DTA” and digital trade chapters in trade agreements / DEAs, is essential for aligning commitments with practical outcomes. A detailed analysis of policy alignments across these different policy tools, trade outcomes, and the reduction of uncertainty within agreements would provide valuable insights into the UK’s progress and areas for improvement. Conducting such an evaluation, similar to studies in other contexts, could guide future policy strategies and enhance the effectiveness of trade agreements.

However, data collection remains a significant challenge in assessing the economic impacts of trade agreements, including DEAs and FTAs. Current datasets often fail to capture nuanced sectoral impacts or asymmetric market dynamics. For instance, the suspension of initiatives like the Digital Economy Survey has created gaps in understanding the effects of trade agreements on services trade. Discussions at the international level often highlight the urgent need for disaggregated data, particularly on gender and engagement with diverse stakeholders. Additionally, leveraging private company data, such as intellectual property payments or platform activities, through secure environments like the UK’s Smart Data Research Hub, could provide critical insights into trade flows often overlooked in traditional aggregated statistics.

Tools like the STRI can be used to quantify the uncertainty embedded in trade policies if comparable companion indices are available that quantify policy restrictiveness at alternative levels of policymaking; in particular, a variant of the STRI for multilateral GATS commitments or for preferential agreements such as CPTPP. However, at present such comparable pairs of policy indices are not widely available. Moreover, even when information is available to measure the extent of “water” in commitments, a trade impact analysis would then require linking this information for country-sector-mode-time combinations to bilateral services trade flows to capture the impacts of granular policy configurations on trade flows.

Another challenge is the ability of trade policies to adapt to fast-growing innovation and technologies and evolving business models. For instance, UK-based Ocado transitioned from a supermarket chain to a logistics-focused service provider, exemplifying how digital trade policies can enhance firms’ ability to engage in cross-border trade. Aligning digital trade chapters with broader cross-border services frameworks is essential to support these transitions effectively. Digital trade provisions have implications that extend beyond traditional metrics, influencing areas such as cross-border data flows, intellectual property protections, rising servitisation where firms integrate service components into goods-based offerings, and healthcare service mobility. Therefore, provisions should be designed in a way that fosters innovation, improves access to essential services, and enhances global value chains, particularly as digitalisation increasingly blurs the distinction between goods and services.

Finally, addressing regulatory asymmetries across countries, such as differences in consumer protection standards and data privacy, is challenging in trade policy negotiations as regulatory autonomy typically lies with national/federal regulatory authorities. For example, while US consumers are accustomed to lower protection levels, UK consumers are used to the UK’s higher standards. Given that 27% of UK digital services exports are directed to the US, addressing regulatory disparities between the UK and the US is critical for advancing trade discussions and ensuring mutual benefits.

The role of digital trade policy in data and AI governance

Balancing economic objectives with public policy goals under digital trade rules

Since leaving the EU and having an independent trade policy, the global trade environment has undergone significant new challenges. The rapid and profound changes in the policy environment raise the question of how the UK’s digital trade policy can respond to, and support, policy challenges associated with the governance of data/AI, and how digital trade agreements could play a role in this process.

While the major objective of FTAs/DEAs is to address the demands of the digital economy and the pitfalls of digital protectionism, each agreement is also a part of global data/AI governance. Digital trade and innovation would benefit from a consistent, mutually compatible, and trustworthy global governance landscape. However, this is difficult to attain because it involves negative externalities as digital trade imposes costs on individuals, businesses or society that are not reflected in the market price (e.g. privacy violations and data exploitation, cybersecurity risks, and market monopolisation) and overriding political considerations, where the priorities and challenges across countries vary.

Thus, there are opportunities and challenges surrounding existing FTAs/DEAs. While FTAs/DEAs are useful devices to improve legal clarity to stakeholders, promote free data flows, and bind dispute resolution mechanisms,9 they tend to suffer from trust deficits, such as transparency concerns during negotiations, lack of stakeholder engagement during policy-making, and public policy imbalances where private interests may overshadow public welfare as a consequence of prioritising free data flows.10 Additionally, the power dynamics within these agreements often enable countries with greater economic heft to impose their regulatory frameworks on partners, thereby further exacerbating public policy deficits.11

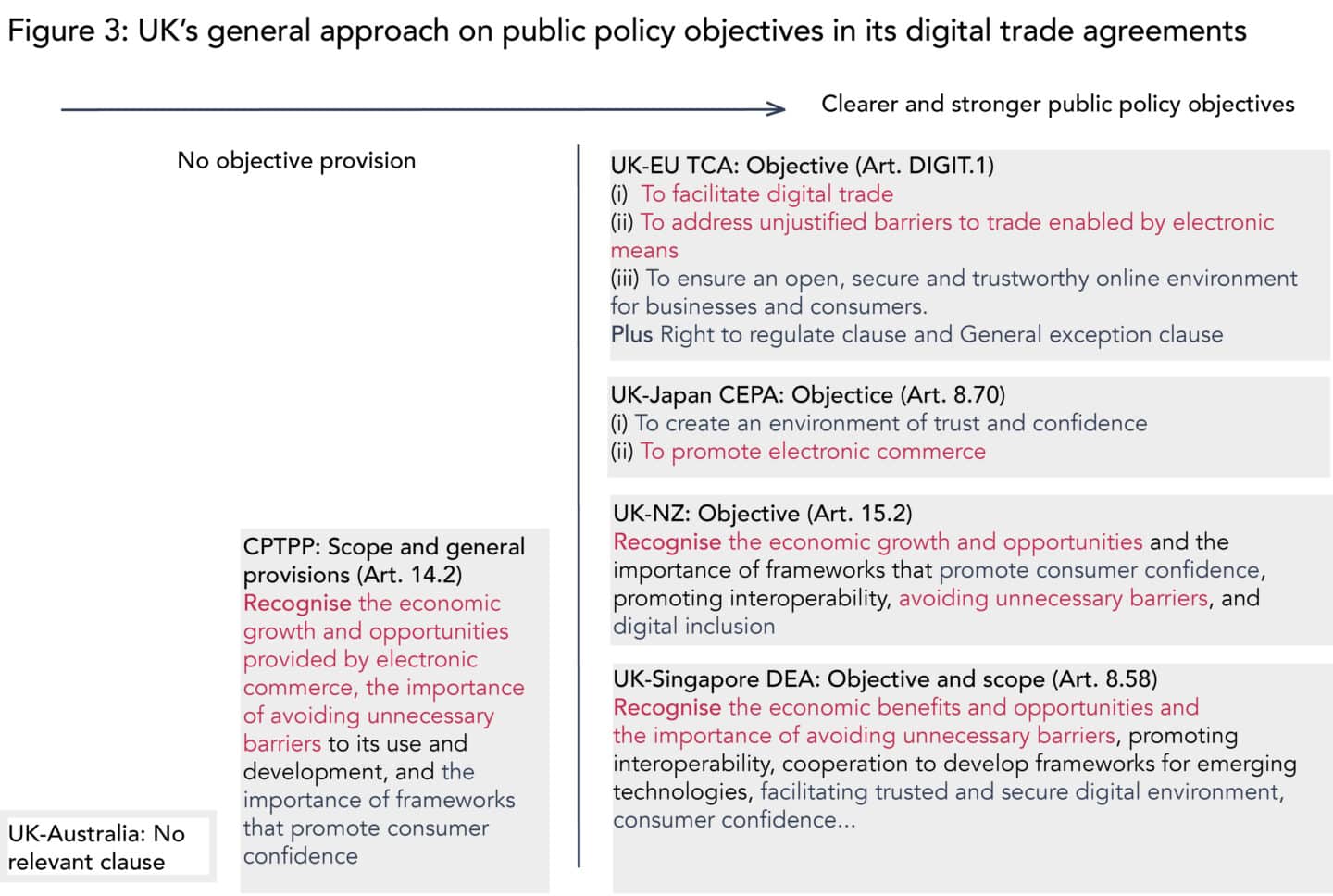

Balancing economic objectives with public policy goals remains a critical issue in designing sustainable and inclusive FTAs/DEAs. One example is provisions relating to public policy space. While economic objectives focus on leveraging the benefits of digital technology and innovation, public policy objectives emphasise managing associated risks and ensuring societal accountability. The UK’s approach to digital trade policy in this context varies across its agreements (Figure 3). For instance, the EU-UK Trade and Cooperation Agreement (TCA) includes explicit provisions for balancing economic and public policy concerns12, such as the right to regulate for legitimate public policy objectives. This heavily reflects the EU’s principle of digital trade governance. In comparison, in other agreements such as the UK’s digital trade agreements with Japan, New Zealand, or Australia, there is no independent “right to regulate” clause or equivalent provisions addressing public policy concerns. Instead, such objectives are incorporated indirectly into data flow or localisation clauses.13 This indicates that while the UK takes a flexible approach in accordance with its trade partners, it lacks basic principles, unlike the EU which puts people at the centre of the digital transformation.

Note: Authors’ elaboration.

The lack of consistent policy principle(s) is particularly challenging when the UK Government needs to address public policy concerns with broader trade objectives. For example, digital trade provisions often promote free data flows and prohibit data localisation requirements and source code disclosure requirements. While these provisions facilitate digital commerce, they could conflict with national security priorities, privacy regulations, and pro-competitive policies designed to prevent the dominance of tech giants. Such conflicts highlight the geopolitical dimensions of digital trade. This can be seen in the withdrawal of the US from supporting the WTO joint statement initiative on E-Commerce citing national security concerns.14 This underscores the need for trade agreements to address domestic data governance frameworks more effectively, ensuring alignment with broader policy concerns.

Principles of domestic data/AI governance and its alignment with international trade agreements

The complex and evolving nature of digital technology presents challenges in setting a domestic regulatory framework and aligning it with international trade agreements.

The World Bank describes the key to ‘data governance’ as protecting the rights and establishing norms and rules concerning rights, principles, and obligations surrounding data use.15 Data governance extends beyond good data management to encompass legal principles, stakeholder duties, and regulatory frameworks that account for the intangibility and dynamic nature of data. The complex chain in data ecosystems—spanning developers, deployers, users, and regulators—adds layers of complexity, requiring regulators to balance competing stakeholder interests and benefits.

In the UK context, this complexity is compounded by the fragmented nature of digital governance, where multiple regulators oversee different aspects of data and AI. Table 1 gives some examples of regulatory collaboration among domestic regulators.16 The UK Government’s pro-innovation white paper proposes better coordination among regulators, and suggests the establishment of a leading body to facilitate dialogue and consensus among clusters of relevant agencies.17 More recently, the UK Government has been pushing regulators to become more ‘pro-growth’, which could lead to pressure for a greater emphasis on economic considerations as opposed to consumer protection. This domestic coherence is essential for translating governance principles into effective international trade agreements. The need for an aligned framework between domestic industrial policy and commitments in international trade agreements is crucial for regulating critical technologies including AI, quantum computing, and semiconductors, where the interplay of data, algorithms, and hardware demands distinct regulatory approaches.

Table 1: Examples of domestic regulatory collaborations

| UK Regulators | Mandates | Examples of Collaboration |

|---|---|---|

| The Office of Communications (Ofcom) | Regulating telecoms, broadcasting and postal sectors | DRCF: the Digital Regulation Cooperation Forum |

| Information Commissioner’s Office (ICO) | Regulator for data protection and information rights | |

| Financial Conduct Authority (FCA) | The regulator for financial services firms and financial markets | |

| Competition and Markets Authority (CMA) | Promotes competition and tackles unfair behaviour in markets | |

| Health Research Authority (HRA) | Regulating health and social care research in England | The AI and Digital Regulations Service |

| Medicines and Healthcare products Regulatory Agency (MHRA) | Regulating medicines, medical devices and blood components for transfusion | |

| National Institute for Health and Care Excellence (NICE) | Assessing the cost-effectiveness of medicines and new health technologies and making them available on the NHS | |

| Care Quality Commission (CQC) | Regulating health and adult social care in England | |

| FCA | The regulator for financial services firms and financial markets | Discussion Paper on the impact of artificial intelligence and machine learning on the supervision of financial firms |

| Prudential Regulation Authority (PRA) | Part of the Bank of England, supervising financial institutions to ensure the safety of financial systems | |

| The Bank of England | Regulating the financial system in the UK |

Note: Authors’ elaboration.

One of the most pressing challenges in AI governance, as laid out also in the EU AI Act18, is product safety, particularly the “black box” dilemma. AI systems often operate autonomously and unpredictably, making it difficult to discern the rationale behind their decisions. Additionally, the quality of input data—often characterised by bias due to the underrepresentation of marginalised groups—raises questions about fairness, inclusivity, and representativeness.

A further challenge lies in the misalignment between the rapid evolution of AI technologies and the slow regulatory approval cycles. While AI systems may become outdated within months, regulatory cycles often span years. This temporal gap necessitates a lifecycle-based regulatory framework that ensures ongoing auditing, monitoring, and risk management. Determining the extent to which liability lies with developers, employers, or end users is a critical consideration in regulatory design.19

Intellectual property (IP) issues add another layer of complexity to data governance. The tension between trade secrecy and patent disclosure requirements poses challenges for digital technology companies. Patenting has been a key driver for innovation based on the idea that a limited period of monopoly is granted in the exchange of publication of the know-how and information previously held secret. Yet, in the AI age, companies increasingly rely on trade secrecy protections which provide indefinite protection for confidential information including proprietary algorithms and training data. While patents require disclosure of technological know-how, this transparency requirement can expose companies to reverse engineering and thereby may compromise their competitiveness. The evolving boundary between patentability and trade secrecy highlights the need for nuanced IP frameworks that balance innovation incentives with the protection of proprietary knowledge.

As a result, transparency, explainability, and interpretability emerge as key principles in data governance. Transparency ensures that AI systems operate in a manner that is understandable to users, while explainability involves providing clear rationales for AI decisions. Interpretability extends these principles, aiming to make AI systems comprehensible within the broader context of their societal and technical impacts. International frameworks, such as the EU AI Act, OECD recommendations, and the UK’s white paper, emphasise these principles as critical for fostering trust and accountability in AI governance.

Inclusivity is another essential consideration, particularly in addressing biases stemming from inadequate dataset representation of certain marginal groups in the demography. Ensuring diversity in training datasets and accounting for the socio-economic and ethnic composition of target populations are crucial for mitigating systemic bias. Risk management approaches must integrate these inclusivity considerations to create governance frameworks that reflect societal diversity.

Finally, the intersection of data governance and international trade agreements presents unique challenges. Addressing the complexities of digital trade governance requires balancing free data flows, privacy and product safety safeguards, and intellectual property protection, including the optimal protection of source code as trade secrets, subject to the transparency requirements – all across countries as opposed to within a country.

Focused agreements like the UK-Singapore Digital Economy Agreement demonstrate the effectiveness of targeted provisions and pilot projects in addressing specific challenges. Given AI’s fast-moving nature, its inclusion in FTAs has been limited, as seen in agreements involving Korea, Singapore, Turkey, and the UAE. For countries like the UK, preserving domestic policy space is crucial to avoid regulatory conflicts.

Policy challenges

FTAs/DEAs impact on data and AI governance. Whereas FTAs/DEAs were initially designed to reduce trade barriers, they are increasingly encroaching on data and AI governance due to a lack of comprehensive international frameworks. As previously explained, public policy objectives within digital chapters in FTAs/DEAs often lack clear legal definitions or case law, leading to debates over their flexibility versus specificity. This ambiguity opens the door to varying interpretations, potentially hindering the promotion of legitimate public policies or allowing discriminatory practices.

Another critical concern relating to FTAs/DEAs is the prioritisation of trade objectives over privacy and consumer protection. Ambitious agreements risk undermining sector-specific frameworks by subordinating regulatory efforts to trade rules. For instance, Japan’s flexible AI training regulations, which permit personal data usage in ways that are currently restricted in the UK, highlight disparities in global data governance that FTAs often fail to resolve.

It is important that governments understand how FTAs/DEAs impact data and AI governance both at the domestic and international levels. As FTAs/DEAs tend to embed regional or bilateral preferences rather than fostering global coherence, overdependence on FTAs/DEAs risks exacerbating policy fragmentation. It would thus be desirable for governments to keep working on the drafted text of the WTO Joint Statement Initiative on E-Commerce to promote multilateral rules.

AI governance demands flexibility and adaptability to keep pace with its rapidly evolving nature. Thus, it requires alternative approaches beyond FTAs. Cooperative agreements with like-minded partners, such as Memorandum of Understanding (MoUs), provide the necessary domestic policy space for regulatory adjustments without the rigidity of binding commitments inherent in FTAs.

FTAs also often fail to accommodate non-commercial data needs, such as those crucial for public health or research purposes. Addressing this gap requires reconciling discrepancies between FTA provisions and their real-world applications.

Finally, institutional fragmentation on data and AI governance needs to be recognised. International institutions (e.g. OECD, UNCTAD and WTO) and thematic international frameworks relating to data governance (e.g. Global Privacy Assembly), which operate with different mandates and priorities, show a fragmented landscape on data and AI governance. This fragmentation is exacerbated by internal divisions within organisations like the OECD, where trade and technology divisions often operate in silos, which further impedes a cohesive approach to data and AI governance. These disjointed approaches underscore the urgent need for more coordinated strategies to address the complexities of data and AI governance effectively.

Aligning digital trade and industrial policy

Digital trade policy and the ‘twin’ transition

Digital trade is increasingly important for UK trade policy and industrial strategy, as a growing share of global trade consists of digital services (Figure 1) which affects UK productivity, innovation competitiveness, global value chain resilience and labour markets. The UK’s strategic position within global digital value chains will impact on its competitiveness but also on its role within the rapidly changing geopolitical landscape, as well as its relationship with the EU.

Digital trade policy exhibits numerous linkages with the broader framework of the UK’s industrial strategy, in particular with regard to emerging technologies such as AI20 - among other digital technologies21 - and the so-called ‘twin’ transition, that is the transition to net zero and the digitalisation of economies. The twin transition is challenging as it often raises trade-offs between these two areas, for instance, the environmental footprint of increased investments in digital infrastructures.22

In this context, the EU’s discourse on ‘open strategic autonomy’ offers a relevant context for the UK to consider, given that the UK Government is aiming to “reset” its relationship with the EU.23 Initially focused on security and defence, the concept of ‘open strategic autonomy’ has evolved to address technological sovereignty and the resilience of supply chains for critical inputs for the digital transition. This approach highlights the need for strategic coordination between industrial and trade policies, particularly in securing raw materials essential for the twin transitions. To remain at the frontier of digital global value chains and maintain long-term competitiveness requires strategic decisions as to where and when the UK will be able to obtain critical inputs in the future.24

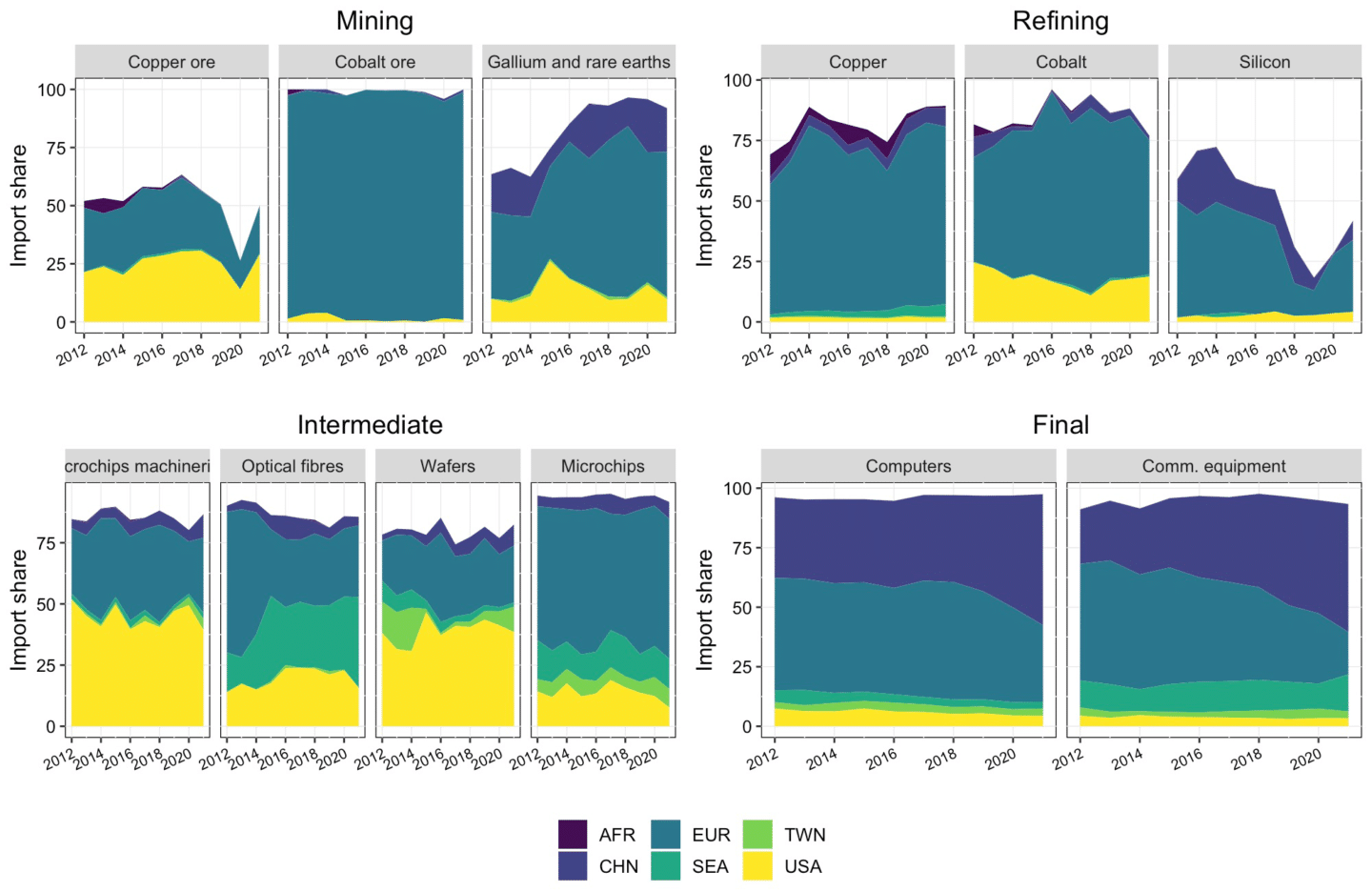

Figure 4 reports evidence of changes since 2012 in import shares, from across broad regions of the world, along critical stages of both digital and green value chains (raw materials, intermediate and final products).

Figure 4 - Digital global value chains - changes of UK’s import shares, over time and across country of origin – 2012-2021

Note: Import shares of the UK from six countries or regions: Africa (AFR), China (CHN), European Union (EUR), South East Asia (SEA), Taiwan (TWN) and the USA. Product names refer to groupings of HS6 codes, identified through product descriptions. Shares do not add up to 100 as countries and regions do not cover the totality of the World, the white area corresponds to imports from the rest of the World. Data Source: BACI-CEPII trade data, based on UNCOMTRADE25

Figure 4 shows import shares of copper and lithium, microchips and computers. The UK sources large shares of its imports from countries located in the six geographical regions we consider. For some key materials, for instance, cobalt and silicon, the UK appears to import large shares from Europe. As European countries are not among the major producers of these materials, this suggests the existence of a complex trade network, including re-exports, most likely dominated by large multinational enterprises (MNEs).26

Concerning intermediate and final stage products, we find that the EU is a main supplier to the UK, although its share of computers and communication equipment is steadily declining. In these two product categories, the UK has been gradually replacing its European suppliers with Chinese exporters. We find a similar picture for green global value chains.

The position of the UK within strategic global value chains is a challenge for both trade and industrial policy, and one way to navigate this intersection for UK trade policy is by identifying and prioritising strategic sectors that underpin the ‘twin’ transition.

Besides critical raw materials and digital intermediates mentioned above, digital infrastructure, such as data centres and cloud service providers (DCCS), are highly significant to the UK’s position in the global digital economy as they represent the physical foundation that supports digital trade.

As of February 2024, the UK holds the second-largest global share of data centres and is welcoming foreign investments in data centres.27 However, a closer examination reveals notable disparities when data centres’ intensity is measured relative to population or GDP, with smaller nations—many thought to be tax havens—exhibiting higher data centre intensity. This distinction points to different drivers behind data centre distribution, including natural conditions that make some countries more attractive, as well as fiscal and environmental policies, regulatory environments, and geopolitical considerations.28 The location of data centres raises challenges for the international governance of data flows.

Policy challenges

Aligning digital trade policies with a broader industrial strategy is essential for the UK to secure its competitive advantages while addressing long-term economic and environmental goals.

First, the UK should aim for a meaningful EU-UK reset. The concept of ‘open strategic autonomy’, particularly within the EU’s regulatory frameworks, provides a framework for managing dependencies in digital and industrial policies. The EU’s emphasis on securing diverse supply chains through near-shoring and friend-shoring reflects efforts to mitigate vulnerabilities in global value chains. For the UK, these shifts necessitate an assessment of its position within global trade networks and its ability to secure critical inputs while maintaining competitiveness. Unlike the EU, which has significant geopolitical influence and domestic capacity, the UK faces constraints in developing domestic capabilities in a range of extractive industries and digital intermediates, whereas it is – as seen – more competitive in digital services. Diversification of supply sources and/or reliance on politically-aligned partners appear to be more feasible options. However, the pursuit of strategic autonomy by the UK must be carefully managed to avoid distorting global markets or exacerbating existing dependencies. This balance is particularly critical in sectors like critical raw materials that are inputs in digital technologies, such as chips, lithium and cobalt.

Second, the UK Government should be forward-looking in deciding whether to attract foreign direct investment or to devote domestic public investments in digital infrastructure, such as data centres. This requires balancing economic benefits with sustainability concerns. While data centres are vital for storing and processing digital information, their economic benefits—particularly in employment creation— can be overstated. Evidence from the United States highlights minimal job creation despite generous tax incentives, raising questions about the broader value of these facilities.

Additionally, their environmental impact, including high energy and water consumption and substantial carbon emissions, complicates their alignment with sustainability objectives. The fiscal implications of profit-shifting through intellectual property charges and licensing arrangements further limit the value captured by host regions. Policymakers need to evaluate critically these trade-offs to ensure that investments in digital infrastructure align with national priorities and contribute meaningfully to long-term economic and environmental goals.

Conclusion

A data and digital trade policy requires a complex mix of economic, societal and industrial policy considerations. The UK can play a role in promoting a sustainable and trustworthy data and digital trade environment at the global level making use of its strong performance on digital trade combined with an ambitious data governance regime at the domestic level.

Given the UK economy’s strong performance on digital trade combined with an ambitious data governance regime at the domestic level, the UK is well positioned to globally promote a sustainable and trustworthy data and digital trade environment. The UK Government should take a proactive role in making digital trade rules at the international level.

Certain combinations of provisions in deep services trade agreements are associated with significant increases in bilateral services trade. It would be worth exploring whether and how the success of these policy configurations could be replicated in digital trade chapters in FTAs or standalone Digital Economy Agreements (DEAs).

Research on goods trade flows shows the beneficial effect of certainty over market access conditions as an independent factor. Joining existing open-ended agreements such as the Digital Economy Partnership Agreement (DEPA) is a way of improving policy certainty and may therefore confer similar benefits, especially for services that require large-scale and/or long-term investments in digital infrastructure or human capital. However, digital trade provisions under bilateral and plurilateral FTAs and DEAs cannot fully address regulatory fragmentation caused by different types of data and digital trade governance at national levels. Different types of bilateral and plurilateral agreements are creating a “digital noodle bowl”. The UK Government’s strong commitment on the multilateral stage, especially efforts towards the WTO Joint Statement Initiative on E-commerce’s successful implementation, is important in mitigating against regulatory fragmentation.

Since trade negotiations at the WTO are affected, and sometimes overridden, by political considerations, the UK Government is encouraged to promote policy dialogues on data and digital trade outside of the WTO, involving a wide range of stakeholders including those outside of conventional policymaking communities.

Data and digital trade policy must be aligned with broader societal objectives such as data privacy, consumer protection, national security and competition policy for long-term economic growth and sustainability. Even though the UK has trade and geopolitical interests involving all three “digital realms”—the US, the EU, and China—it is important to establish a coherent policy approach across all trade partners. The UK Government should review key provisions in UK trade agreements (and DEAs) including (i) the provisions regarding free data flows and restrictions of data localisation requirements, (ii) restrictions of source code requirements, (iii) national security exemptions, and (iv) general provisions regarding public policy exemptions.

Since hard laws cannot be a comprehensive policy mechanism for data and digital trade, regulatory cooperation using soft law, such as sectoral standards and Memorandum of Understandings (MOUs) with like-minded trade partners, can be pursued alongside the promotion of more formal agreements.

We strongly encourage the UK Government to promote a multi-stakeholder approach to building a sustainable and trustworthy data and digital trade environment. Institutional mechanisms that enable a wide range of stakeholders, both business and non-business, to have a voice in policymaking and implementation processes should be established.

Offering evidence-based policy advice in the realm of data flows and digital trade is extremely challenging owing to the paucity or non-existence of sufficiently detailed data on e.g. digital trade or the ways in which UK businesses partake in the digital economy. Hence, the UK Government should improve both the collection of relevant statistics and its conditions of access for civil service and academic researchers.

By integrating digital policy with industrial strategy and aligning with global frameworks like the EU’s Open Strategic Autonomy, the UK can position itself effectively within global value chains. The ‘twin transition’ required to move towards a carbon-neutral and digital economy creates trade-offs for digital trade policy making. Aligning trade policy with the UK’s industrial strategy would involve, inter alia, ensuring access to critical technologies, critical minerals and supporting resilient supply chains. Alignment with the EU Open Strategic Autonomy can address the trade-off between the increasing dependence on China for critical materials and intermediates and the reliance on the EU Single Market as a major destination for UK exports. Policymakers should approach investments in digital infrastructure, such as data centres, with a comprehensive understanding of their economic, environmental, and strategic trade-offs. These investments should, on balance, support broader national goals including fostering competitiveness and sustainability in an increasingly interconnected global economy.

Footnotes

- The OECD defines digital trade as “trade in goods and services that are digitally ordered or delivered, or digitally facilitated by a data flow”. The “Handbook on Measuring Digital Trade (Second edition)”, jointly prepared by the International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD), the United Nations Conference on Trade and Development (UNCTAD) and the World Trade Organization (WTO), offers this statistical definition of digital trade: “digital trade is all international trade that is digitally ordered and/or digitally delivered”.

- Morita-Jaeger, M. and Smith, F. (2024). From ‘efficient’ to ‘resilient’ supply chains, and beyond”, UKTPO blog, 18 December 2024.

- Ruiz Diaz, J. and Savona, M. (2024). The US turn is reshaping the geopolitics of digital trade. What does this mean for the UK?, CITP blog, December 2023.

- There is analysis on the US’s ongoing policy shift. See Akselrod, L. and Venzke, C. (2025). Trump’s efforts to dismantle AI protections, Explained.

- A DIP is an online provider connecting users, such as buyers and sellers, service providers and customers, or content creators and consumers. DIPs facilitate transactions, communication, or interactions without directly providing the goods or services themselves.

- Bacchus, J., Borchert, I., Morita-Jaeger, M., and Ruiz, J. (2024). Interoperability of Data Governance Regimes: Challenges for Digital Trade Policy, CITP Briefing Paper 12. And6 Goos, M. and Savona, M. (2024). The governance of artificial intelligence: Harnessing opportunities and mitigating challenges. Research Policy, Volume 53, Issue 3, 2024

- There is one paper which provides economic analysis of UK’s digital trade agreements. See López González, J., Sorescu, S., and Del Giovane, C. (2023). Making the most out of digital trade in the United Kingdom, OECD Trade Policy Papers No. 285.

- Borchert, I. and Di Ubaldo, M. (2021). Deep Services Trade Agreements and their Effect on Trade and Value Added, World Bank Policy Research Working Paper 9608.

- See for example, Aaronson, S.A. (2023) ‘Building Trust in Digital Trade Will Require a Rethink of Trade Policy-Making’, Oxford Review of Economic Policy 39(1), pp. 98–109. And Burri, M. (2021) ‘Data Flows and Global Trade Law’, M. Burri (ed), Big Data and Global Trade Law, Cambridge University Press, pp. 11–41.

- See for example, Aaronson (2023); Burri, M. (2023) ‘Cross-border Data Flows and Privacy in Global Trade Law: Has Trade Trumped Data Protection?’, Oxford Review of Economic Policy 39(1), 85–97. And Scassa, T. (2021) ‘Rights in Data, the Public Interest, and International Trade Law’, I. Bochert and L.A. Winters (eds), Addressing Impediments to Digital Trade, CEPR Press, pp. 195–217.

- Burri (2023).

- UK-EU TCA Objective (Art. DIGIT.1)

(1) To facilitate digital trade, (ii) To address unjustified barriers to trade enabled by electronic means and (iii) To ensure an open, secure and trustworthy online environment for businesses and consumers. Plus, the right to regulate clause (Art. DIGIT 3) and General exception clause (art.) - CPTPP Art 14.2: Scope and general provisions: Recognise the economic growth and opportunities provided by electronic. Commerce, the importance of avoiding unnecessary barriers to its use and development, and the importance of frameworks that promote consumer confidence; UK-Australia does not contain such relevant clause.

- https://www.reuters.com/world/us/us-drops-digital-trade-demands-wto-allow-room-stronger-tech-regulation-2023-10-25/ ; See Morita-Jaeger, M. (2023). ‘Can trade policy enable “Data Free Flow with Trust?’, CITP.

- https://wdr2021.worldbank.org/stories/governing-data/

- DSIT (2024) Implementing the UK’s AI Regulatory Principles: Initial Guidance for Regulators. February 2024. https://assets.publishing.service.gov.uk/media/65c0b6bd63a23d0013c821a0/implementing_the_uk_ai_regulatory_principles_guidance_for_regulators.pdf

- DSIT (2023). A pro-innovation approach to AI regulation, Policy paper, 3 August 2023.

and DSIT (2024). A pro-innovation approach to AI regulation: government response, 6 February 2024. - See https://digital-strategy.ec.europa.eu/en/policies/regulatory-framework-ai, enforced in August 2024.

- Li P, Gilbert S, Anderson S, Williams R. (2023. ‘Regulating AI/ML in SaMD: mapping the experimental space for AI adoption’, Law, Technology and Humans 5 (2), pp.94-113.

- https://www.gov.uk/government/publications/ai-opportunities-action-plan-government-response/ai-opportunities-action-plan-government-response.

- https://assets.publishing.service.gov.uk/media/66f50b2f30536cb92748274b/defining_and_measuring_the_uk_digital_economy.pdf

- See Borchert, Frabboni, Kira, Lydgate, Nyambinya and Sasmal (2023), ‘Addressing the climate gap in digital technologies’, CITP Briefing Paper 8; Papadakis, I. and Savona, M. (2024) ‘The uneven geography of digital infrastructure’, CITP Briefing Paper 16.

- See ‘The UK-EU Reset: What can be done on trade?’, CITP Discussion Note, 19 December 2024.

- Di Biaggio, L., Nesta, L. Vannuccini, S. (2024) ‘European Sovereignty in Artificial Intelligence. A competence based perspective’, LEAP Working Paper 20/2024.

- Gaulier, G. and Zignago, S. (2010) BACI: International Trade Database at the Product-Level. The 1994-2007 Version. CEPII Working Paper, N°2010-23.

- Looking at cobalt, for example it is well-known that most of the cobalt is mined in the Democratic Republic of Congo. It is therefore likely that the cobalt is exported to a third, intermediate country, before being imported in the UK.

- See https://www.gov.uk/government/news/tech-secretary-welcomes-foreign-investment-in-uk-data-centres-which-will-spur-economic-growth-and-ai-innovation-in-britain

- Papadakis, I. and Savona, M. (2024) ‘The uneven geography of digital infrastructure’, CITP Briefing Paper 16.

Note: Whilst we aim to make all our data accessible for the graphs and charts in this paper, it has not been possible. If you require further information on the data used, please contact the authors.

Author Profiles

Minako Morita Jaeger

Phoebe Li

Centre for Inclusive Trade Policy home page

Centre for Inclusive Trade Policy home page